Is Food Delivery still cooking or are taste buds changing?

The rise in the use of Food Delivery apps has been well documented with the pandemic serving up a hearty main course for many of the industry’s participants. However, as we have emerged from the depths of lockdowns delivering consistent tailwinds for growth in 2020 and 2021, we ask the questions – how has this sector performed through the first half of 2022? And what is the outlook in the current economic environment?

Are performance temperatures rising in this sector?

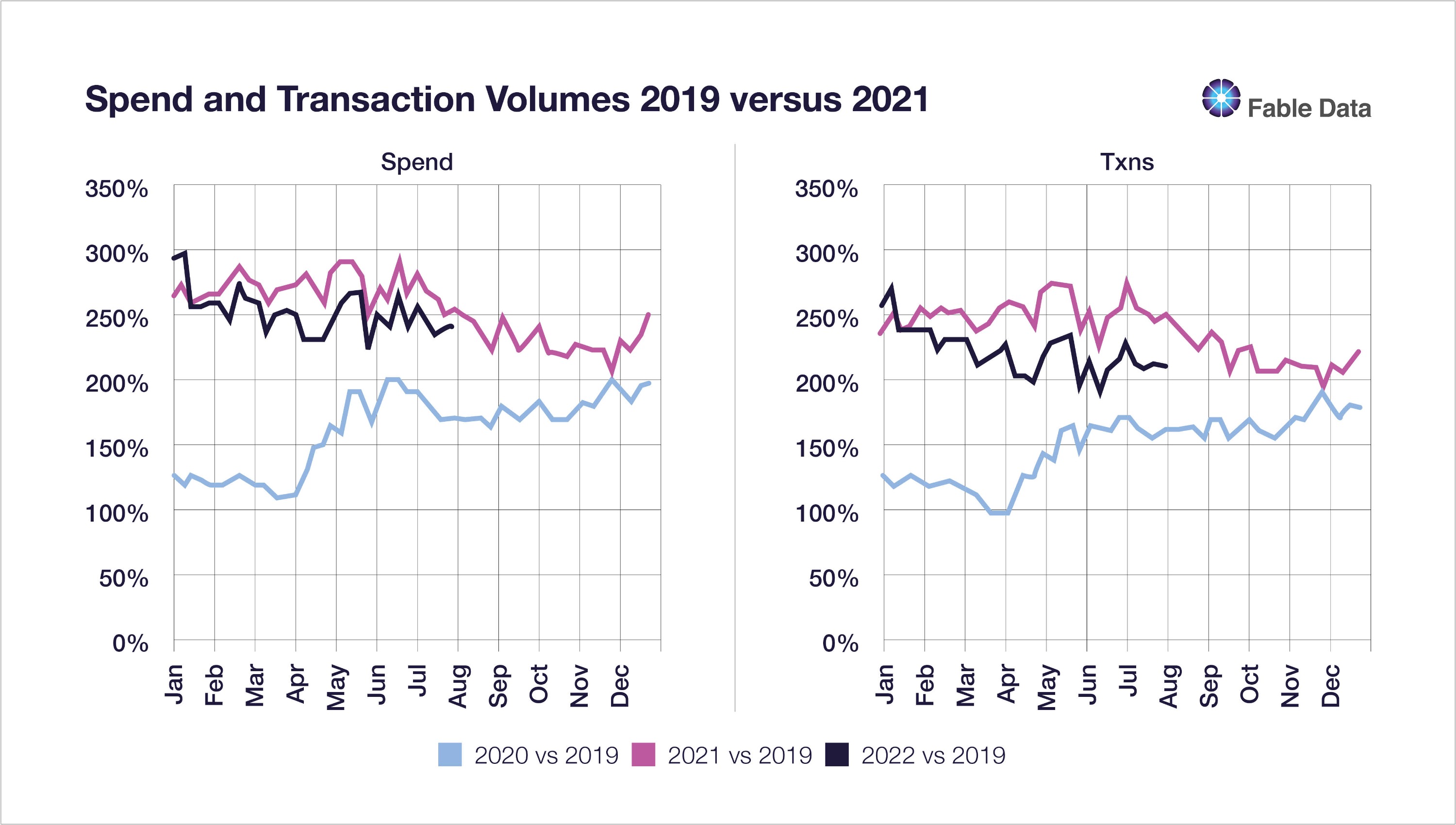

In the context of pre-Covid 2019 levels, Fable’s data highlights that the Food Delivery sector continues to perform relatively well, with both spend and transaction volumes still over 200% higher than before the pandemic.

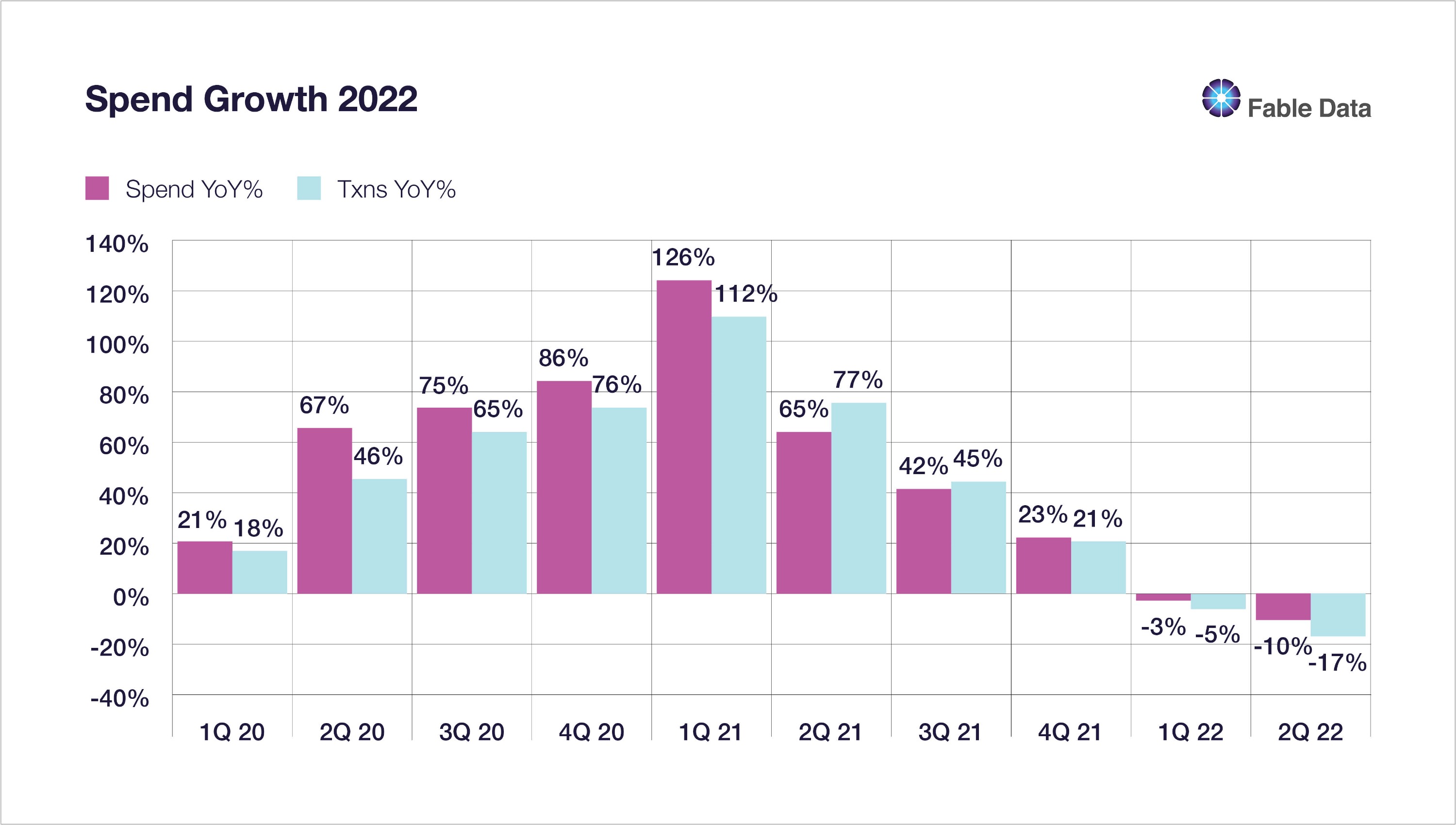

However, it is also clear from our data that relative to last year, momentum has been slowing for some time, with the YoY growth in spending negative through the first two quarters of 2022, and trends worsening in the latter part of Q2.

Recent Reviews

The more challenging conditions for market growth shown in our data have been confirmed by the most recent earnings results of the big 3 players in the UK Food Delivery sector, Deliveroo, Just Eat and Uber Eats.

In this context, Deliveroo called out “challenging market conditions”, citing the threat of a worsening cost of living crisis as a key factor contributing to growth having “slowed sequentially in Q2 compared to Q1”. Similarly, Just Eat reported a 14% decline in UK & Ireland orders in Q2 compared with flat growth YoY in Q1. Additionally, the growth outlook for these companies are also clearly being tempered with more caution with a noticeable shift in commentary towards profitability, and pursuit of adjacent avenues for growth e.g. partnerships are increasingly in focus.

A taste test in Q3 so far…

Halfway through Q3, we are beginning to get a good read on the performance of the sector. Thus far, there are no signs of growth headwinds abating with spend and transactions continuing to decline, albeit not yet to the same extent as in Q2.

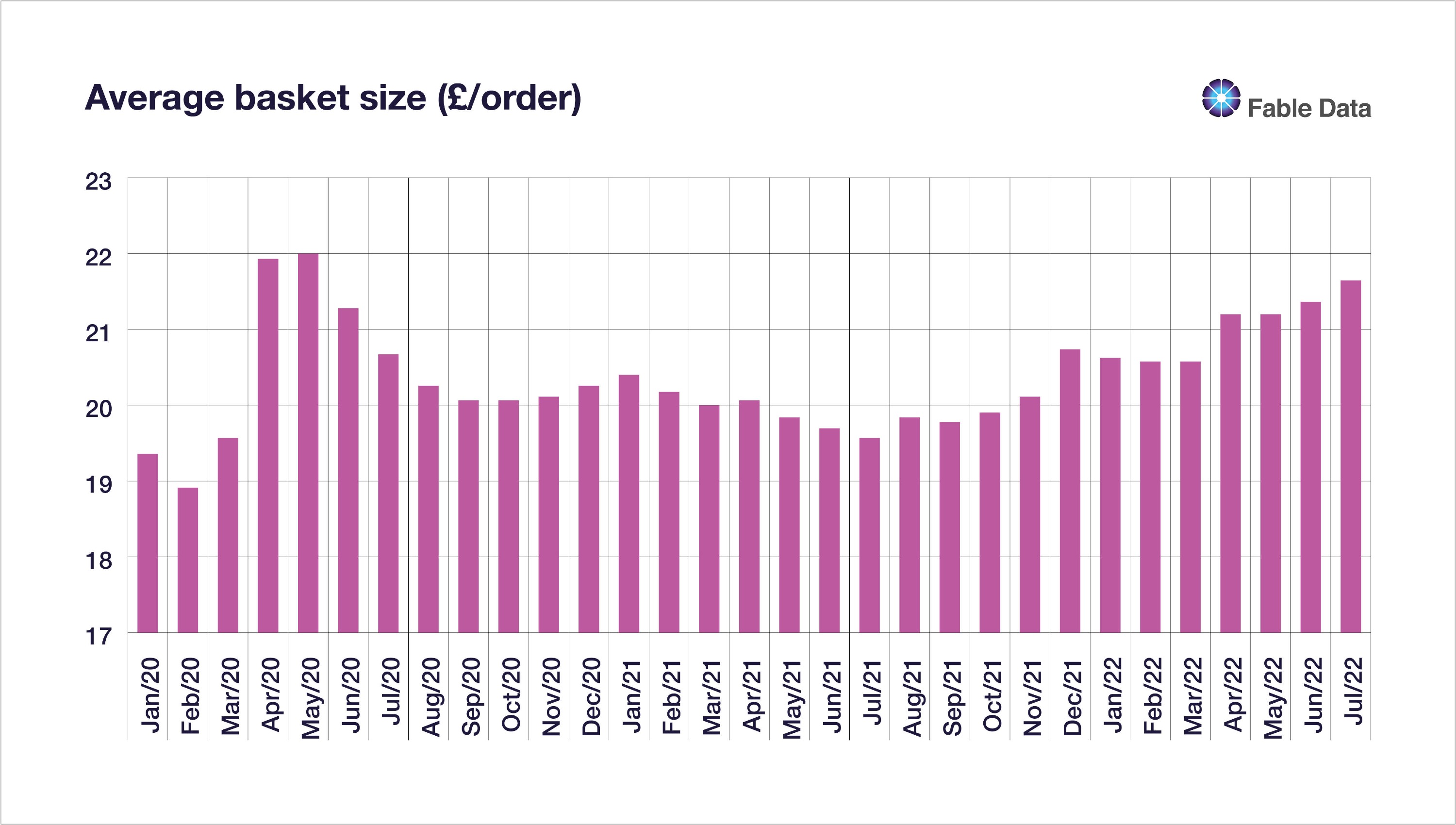

Portion sizes are rising

We are also seeing Inflationary pressures continuing to feed through to higher prices for consumers, with average transaction/order sizes rising rapidly through Q2 and steeply again thus far in Q3. While this remains one positive lever of additional topline growth for Food Delivery companies who collect commissions based on order sizes before charging customers delivery fees and service charges, the impact of rising prices on demand and additional transport costs to couriers must also be considered.

Lifting the lid on the ingredients

Like any good dish there is a lot more going on than what we might first see.

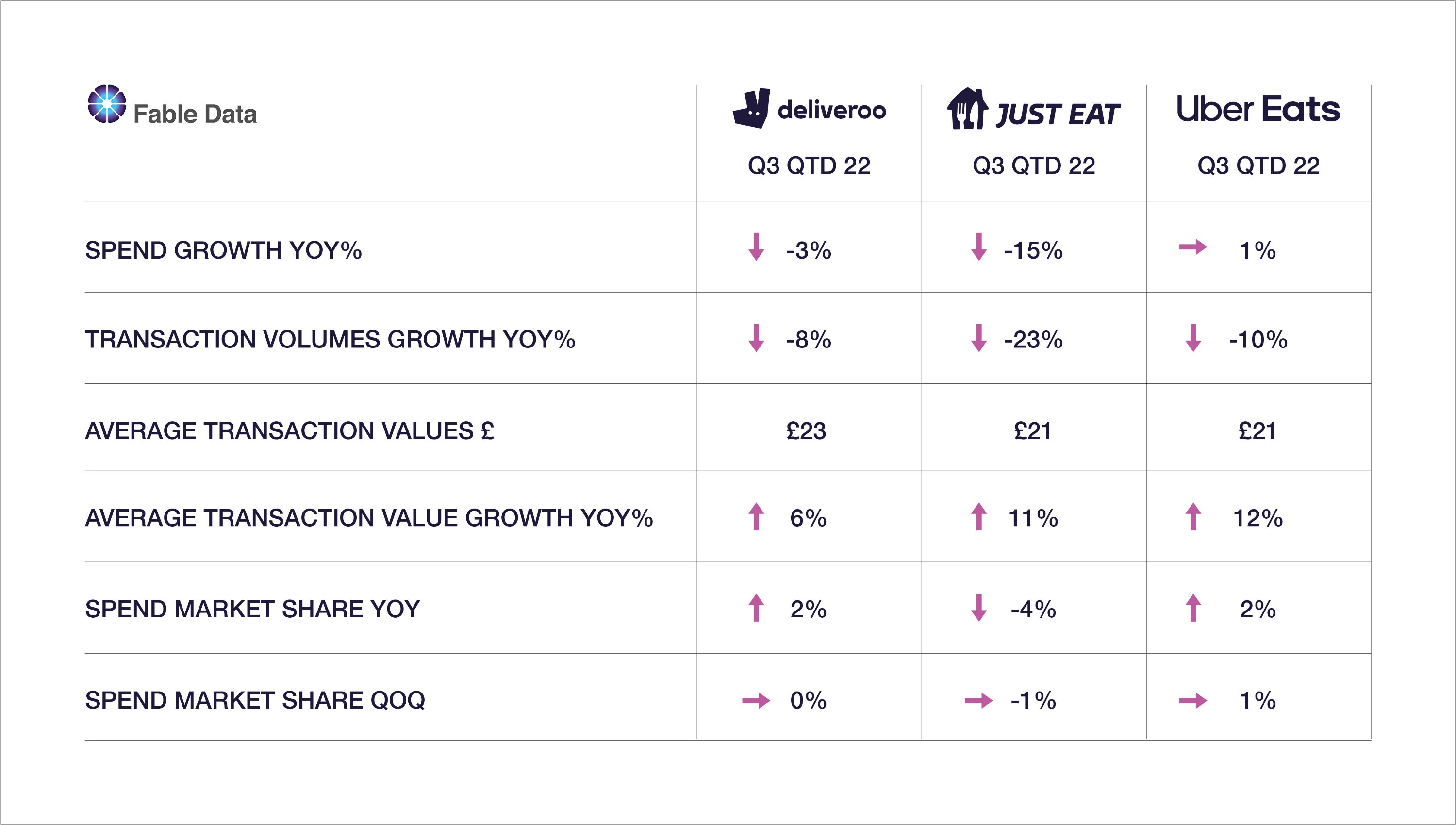

Fable Data highlights through the early part of Q3 that while sector growth is not as strong as last year, interestingly not all players are seeing commensurate declines.

The largest losses are being experienced by Just Eat, while Deliveroo declines are more modest. Uber Eats has also seen a relatively large decline in transaction volumes but the impact of rising average order values is seeing spending keep pace with last year.

Market share dynamics are broadly similar to the trend seen over the last twelve months, with Uber Eats and Deliveroo continuing to take share. Deliveroo remains the premium brand of the large three competitors although, competition in this space continues to heighten with the emergence of new players and other large competitors also seeing rising order values relative to last year.

So, what’s on the menu for the rest of 2022?

The success of Food Delivery apps through the pandemic has been clear to see, having made significant inroads into the hearts and stomachs of many Britons.

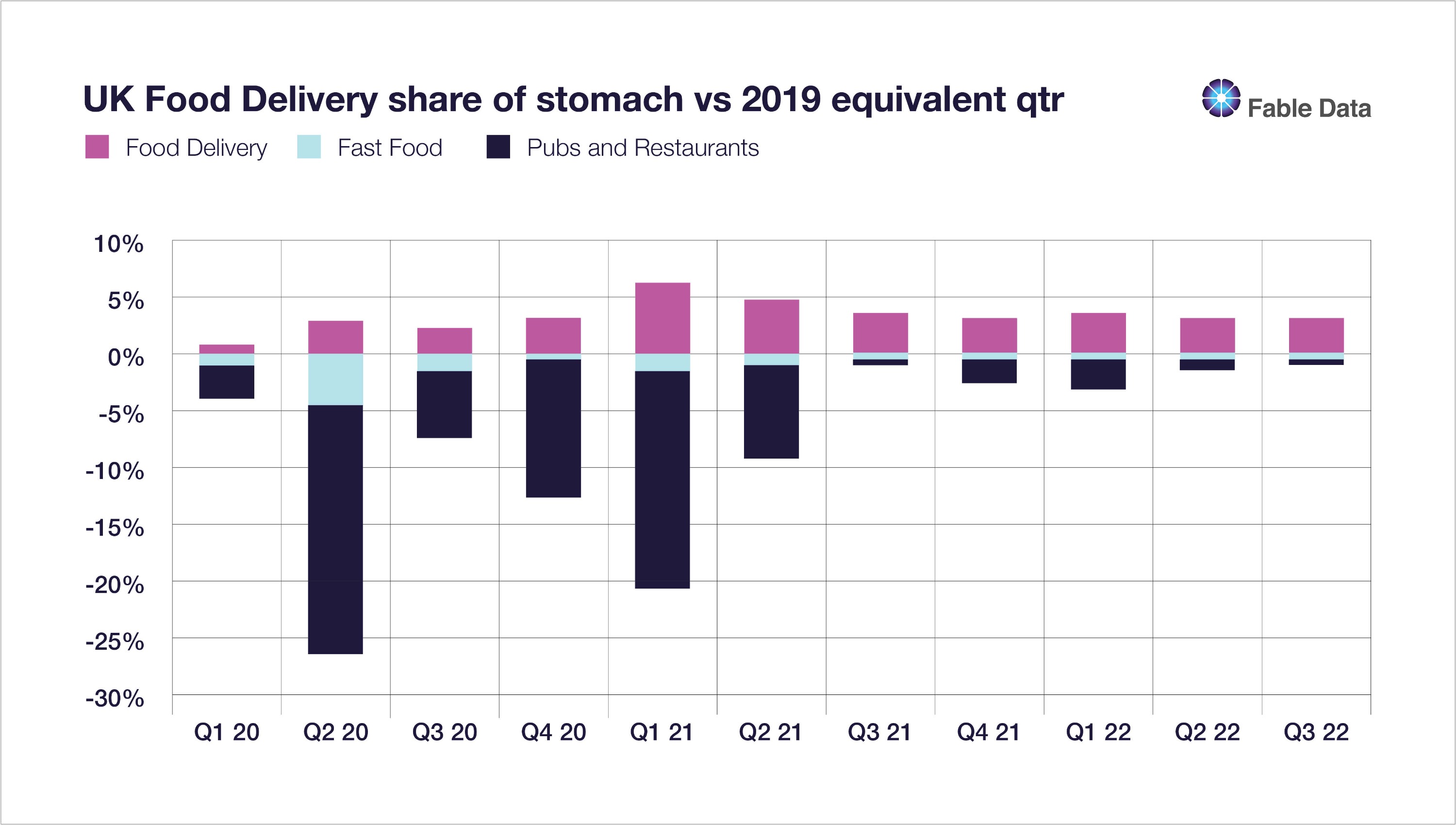

While the tailwinds of lockdown are no longer at play, even as more traditional alternatives such as dining out have once again become a part of our everyday lives, Fable’s data indicates that consumers are still valuing the strong convenience proposition that the food delivery model provides. Moreover, even as Pubs & Restaurants spend as a proportion of overall ‘Food Spend’ (Grocery, Pubs & Restaurants, Fast Food, Food Delivery) has returned back to near 2019 levels, we have still seen Food Delivery spend maintain a much higher share of overall food spend vs pre-Covid levels.

The return of Pubs & Restaurant spending over the last twelve months was arguably foreseeable, however, the outlook for consumer demand remains uncertain as consumer wallets are likely to further tighten through the latter part of 2022.

One possibility is that the appetite for dining out post the pandemic may wane, with a shift back towards more affordable dining options. We are already beginning to see some examples of consumers being more cost-conscious across the UK Grocery sector*.

This could arguably be positive for the Food Delivery sector with more meals being consumed at home, albeit with rising costs being passed on to consumers and an increasing focus on profitability it is not certain how beneficial this would be. Equally possible is that the competitive landscape will continue to heighten with the emergence and rise of other food convenience style apps, plus improving UK grocer and restaurant online distribution channels.

While the pandemic served up a hearty main course for many players in the Food Delivery sector, the next course will in many ways determine the strength of these new bonds and just how long-lasting consumer memories and taste buds really are.

Previous articles

Grocery demand soars whilst takeaway delivery growth moderates

UK food delivery what can customer cohorts tell us about behaviour trends

UK food delivery our latest insights-on whether consumer growth will slow post lockdown

*The value of micro data analysis in the grocery sector the day aldi came to town

Avinash Srinivasan, Fundamental Equity Analyst, Fable Data, avinash@fabledata.com

About Fable Data

Fable Data is an Award winning pioneer in the European real time consumer transaction data market. We own the most comprehensive anonymised dataset of European banking and credit card data, supplied directly from source and based on millions of European consumers.

In addition to partnering with leading financial providers, Fable has a stellar client base of global Tier 1 Investors and Fortune 500 companies. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis is shared, at no cost, with global decision-makers.

Fable’s real-time view of the global economy informs better decision-making in business, government, research, and development.